23 May 2017

Further to the announcement on 19 May 2017 that Chris O’Shea, Chief Financial Officer, was stepping down from the Smiths Group Board, the Company is providing the following information pursuant to section 430(2B) of the Companies Act 2006.

- Mr O’Shea stepped down from his role as Chief Financial Officer and as a director of the Company on 19 May 2017 and commenced a period of garden leave. His employment is expected to end on 18 November 2017 but may end at an earlier date (“Exit Date”) on payment in lieu of notice.

- In the period to the Exit Date Mr O’Shea will be entitled to base salary (£507,375 per annum), benefits and pension allowance in accordance with the terms of his existing employment contract and as described in the directors’ remuneration report for the financial year ending 31 July 2016 (“2016 DRR”).

- Mr O’Shea will be eligible for a pro-rated annual bonus payment (which will be paid two thirds in cash and one third in deferred shares) in respect of the part of the financial year ending 31 July 2017 for which he was in active employment. The amount of this bonus will be reported in the relevant directors’ remuneration report.

- Mr O’Shea retains his eligibility to his outstanding share award under the buy-out arrangements as described in the 2016 DRR.

- The remuneration committee has exercised its discretion in accordance with the rules of the Company’s Long Term Incentive Plan so that Mr O’Shea’s existing share awards under those plans will be preserved on a pro-rata basis and will vest on their normal vesting dates subject to satisfaction of the applicable performance conditions. Information on the vesting of these share awards, and any consequential dividend equivalents, will be disclosed in the relevant directors’ remuneration reports following vesting.

- Mr O’Shea will be entitled to exercise his option under the Company’s Sharesave Scheme using his accrued savings in the six months following the Exit Date.

- The Company has made a contribution of £10,000 (plus VAT) towards Mr O’Shea’s legal fees incurred in connection with these arrangements.

- Mr O’Shea will continue to be covered by the Company’s D&O insurance and his indemnity in respect of third party liabilities will continue in force according to its terms.

General media enquiries

Contact our global media and communications team at:

Please note – the press team can only answer enquiries from accredited members of the press.

Related articles

Smiths Group becomes member of the Manufacturing Technology Centre

Read our latest company news as Smiths Group becomes a member of the Manufacturing Technology Centre

Find out more

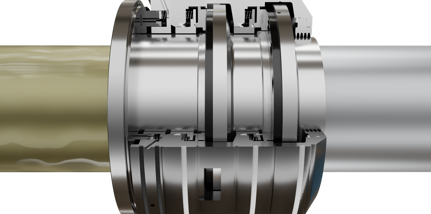

John Crane launches next-generation Coaxial Seal

Find out more

Smiths Group Foundation launches second round of charitable donations

Read our latest company news as the Smiths Group Foundation launches a second round of charitable donations

Find out more