25 September 2002

Highlights:

- Operating profit of 452m from continuing activities

- Profit margin of 15% on sales of 3.1 billion

- Operating cash after capex of 473m, free cash-flow of 315m

- Debt reduced by 395m to 725m, helped by cash-flow and disposals

- Earnings per share on continuing activities of 52.3p

- Civil aerospace slowdown balanced by strong defence business

- Substantial increase in demand for detection equipment

- Medical division increasing its focus on product innovation

- Increased final dividend of 16.75p, making an annual total of 25.5p

Commenting on the results, Keith Butler-Wheelhouse, Chief Executive said:

These results prove our resilience in tough times. We are limiting the impact of the global slowdown by cutting costs and concentrating on margins and cash-flow. We are not counting on near-term market improvements, particularly in the US where we generate half of our revenues. But we are focusing the company on our growth opportunities, which will enable Smiths to deliver a robust performance in the period ahead.

ENDS

General media enquiries

Contact our global media and communications team at:

Please note – the press team can only answer enquiries from accredited members of the press.

Related articles

Annual Results for the year ended 31 July 2025

Find out more

Smiths Detection selected as security technology provider to International Airport Heraklion Crete

Read our latest company news as Smiths Detection announces selection to supply a suite of leading security screening solutions to International Airport Heraklion Crete

Find out more

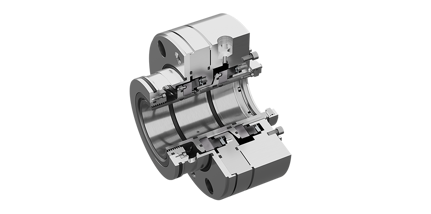

John Crane unveils game-changing mechanical seal, setting new benchmark for ethane pipeline performance

Read our company news as John Crane has launched a new mechanical seal

Find out more