Climate change

Climate change

Decarbonising our world

The UN’s critical global climate objectives have the ambition to limit global warming to 1.5°C. How can net zero be achieved?

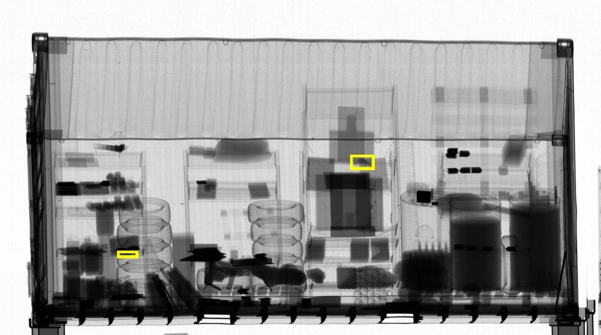

Safety & Security

Safety & Security

Data connectivity

Data connectivity